Taxes can be complicated, but with the right tips and strategies, Canadians can easily navigate tax season and save more money. Whether you’re an individual filer or a business owner, staying informed about Canada’s tax system is the key to optimizing your returns. PC Tax Solutions specializes in helping individuals and businesses navigate tax season. Explore our Tax Preparation Services to learn how we can assist you.

1. Know Your Tax Bracket

Understanding which federal and provincial tax brackets your income falls into can help you effectively plan your deductions and credits.

2. Take Advantage of Tax Credits

Canada offers a variety of tax credits, such as:

Climate Action Incentive: Available in specific provinces to offset carbon tax costs.

Canada Caregiver Credit: For those supporting dependents with physical or mental impairments.

3. Deduct RRSP Contributions

Contributions to a Registered Retirement Savings Plan (RRSP) lower your taxable income and help you save for the future.

4. File Online for Faster Processing

Using certified tax software can ensure accurate calculations and faster refunds.

5. Keep Track of Medical Expenses

You may claim eligible out-of-pocket medical expenses for yourself or your dependents.

6. Small Business Tax Deductions

If you’re self-employed or own a business, ensure you claim deductions for business expenses like home office costs, utilities, and more.

7. Know the Deadlines

Avoid penalties by keeping track of key dates:

- Personal Tax Filing Deadline: April 30

- Self-Employed Deadline: June 15, but payment is due by April 30.

8. Childcare Costs

Claim expenses like daycare or after-school programs under the childcare deduction.

9. Use Tax-Free Savings Accounts (TFSA)

Investments made in a TFSA grow tax-free, providing an excellent opportunity for long-term savings.

10. Hire a Professional

A tax professional can identify deductions and credits you may overlook, ensuring maximum savings and compliance with Canada’s tax regulations.

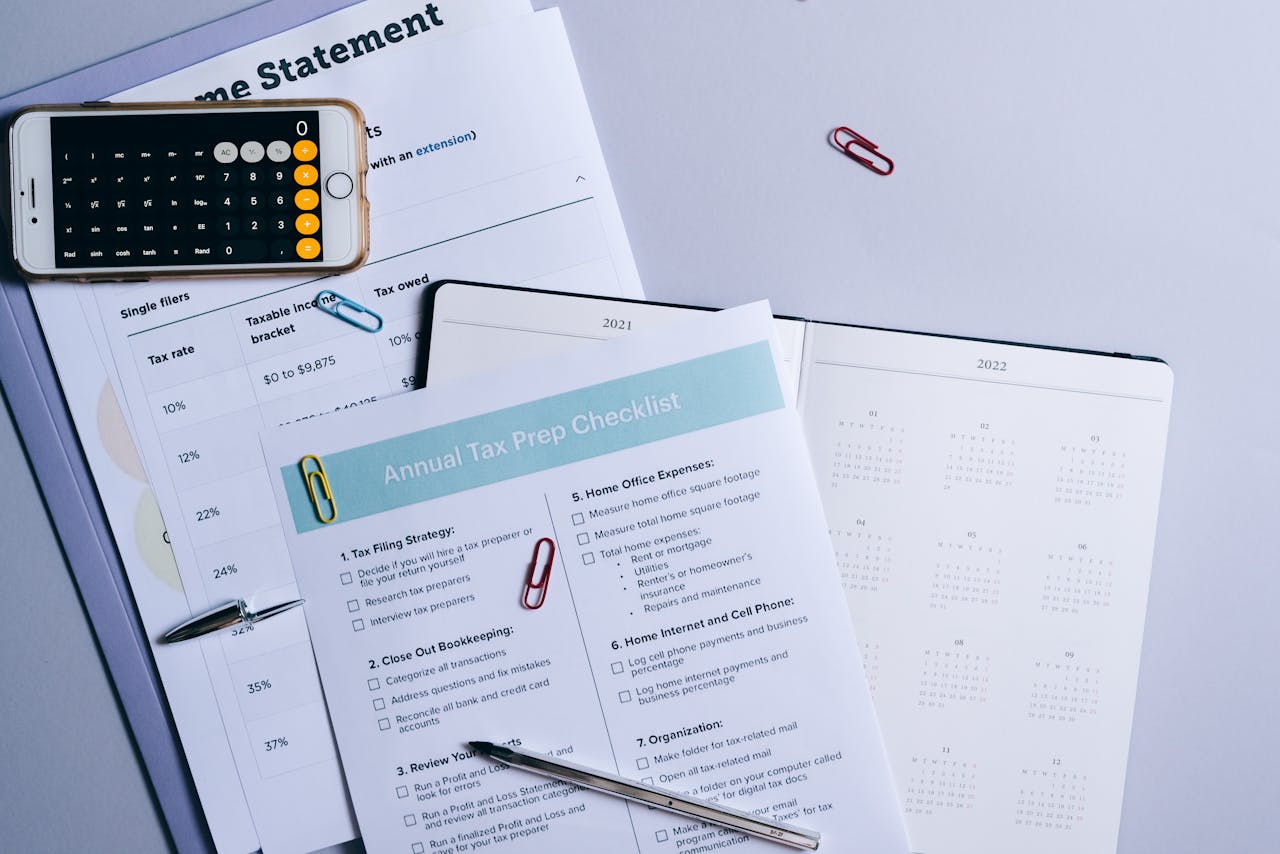

Tax season can be stressful, but preparing in advance makes it easier. Start by organizing your receipts, income statements, and tax forms. Use tools like certified tax software or consult a professional for accurate filings. Staying informed about standard deductions and credits can help maximize your return.